Contrary to popular belief, the conduct of nations on the international stage is almost never driven by moral considerations, but rather by a shadowy cocktail of money and geopolitics. As such, when you see the mouthpieces of the ruling class begin to demonize a foreign country, the first question in your mind should always be “what is actually at stake here?”

For the last six years the Federal Reserve has pumped over $110 million dollars into the U.S. economy – every single hour. This stimulus program is called Quantitative Easing, or as it’s more commonly known, QE.

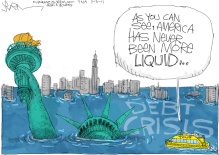

On September 30th, 2013 the U.S. national debt was sitting at$16,738,183,526,697.32. As I write this, the U.S. national debt is sitting at $17,742,108,970,073.37. That means that the U.S. national debt has actually grown by more than a trillion dollars in less than 12 months.

This is the greatest government debt bubble in the history of the world, yet very few people seem to have any desire to do anything about this.

The U.S. national debt has increased by more than 7 trillion dollars since Barack Obama has been in the White House. By the time Obama’s second term is over, we will have accumulated about as much new debt under his leadership than we did under all of the other U.S. presidents in all of U.S. history combined.

Cloward and Piven taught that America could only be destroyed from within. Only by overwhelming the system with debt, welfare, and entitlements could capitalism and the America economy be destroyed. So the plan was to make a majority of Americans dependent on welfare, food stamps, disability,unemployment, and entitlements of all kinds. Then, under theweight of the debt, the system would implode and the economy collapse, bankrupting business owners (i.e. conservative donors). Americans would be brought to their knees, begging for big government to save them.

Transcript:

For some time now Russia, China, Iran, and Syria have been in the cross hairs. Once you understand why, the events unfolding in the world right now will make much more sense.

The U.S. dollar is a unique currency. In fact its current design and its relationship to geopolitics is unlike any other in history. Though it has been the world reserve currency since 194 this is not what makes it unique. Many currencies have held the reserve status off and on over the centuries, but what makes the dollar unique is the fact that since the early 1970s it has been, with a few notable exceptions, the only currency used to buy and sell oil on the global market.

Prior to 1971 the U.S. dollar was bound to the gold standard, at least officially. According to the IMF, by 1966, foreign central banks held $14 billion U.S. dollars, however the United States had only $3.2 billion in gold allocated to cover foreign holdings.

Translation: the Federal Reserve was printing more money than it could actually back.

The result was rampant inflation and a general flight from the dollar.

In 1971 in what later came to be called the “Nixon Shock” President Nixon removed the dollar from the gold standard completely.

At this point the dollar became a pure debt based currency. With debt based currencies money is literally loaned into existence.

Approximately 70% of the money in circulation is created by ordinary banks which are allowed to loan out more than they actually have in their accounts.

The rest is created by the Federal Reserve which loans money that they don’t have, mostly to government.

Kind of like writing hot checks, except it’s legal, for banks. This practice which is referred to as fractional reserve banking is supposedly regulated by the Federal Reserve, an institution which just happens to be owned and controlled by a conglomerate of banks, and no agency or branch of government regulates the Federal Reserve.

Now to make things even more interesting these fractional reserve loans have interest attached, but the money to pay that interest doesn’t exist in the system. As a result there is always more total debt than there is money in circulation, and in order to stay afloat the economy must grow perpetually.

This is obviously not sustainable.

Now you might be wondering how the dollar has maintained such a dominant position on the world stage for over forty years if it’s really little more than an elaborate ponzi scheme.

Well this is where the dollar meets geopolitics.

In 1973 under the shadow of the artificial OPEC oil crisis, the Nixon administration began secret negotiations with the government of Saudi Arabia to establish what came to be referred to as the petrodollar recycling system. Under the arrangement the Saudis would only sell their oil in U.S. dollars, and would invest the majority of their excess oil profits into U.S. banks and Capital markets.

The IMF would then use this money to facilitate loans to oil importers who were having difficulties covering the increase in oil prices. The payments and interest on these loans would of course be denominated in U.S. dollars.

This agreement was formalized in the “The U.S.-Saudi Arabian Joint Commission on Economic Cooperation” put together by Nixon’s Secretary of State Henry Kissinger in 1974.

Another document released by the Congressional Research Service reveals that these negotiations had an edge to them, as U.S. officials were openly discussing the feasibility of seizing oil fields in Saudi Arabia militarily.

In the United States, the oil shocks produced inflation, new concern about foreign investment from oil producing countries, and open speculation about the advisability and feasibility of militarily seizing oil fields in Saudi Arabia or other countries.

In the wake of the embargo, both Saudi and U.S. officials worked to re-anchor the bilateral relationship on the basis of shared opposition to Communism, renewed military cooperation, and through economic initiatives that promoted the recycling of Saudi petrodollars to the United States via Saudiinvestment in infrastructure, industrial expansion, and U.S. securities.

The system was expanded to include the rest of OPEC by 1975.

Though presented as buffer to the recessionary effects of rising oil prices, this arrangement had a hidden side effect. It removed the traditional restraints on U.S. monetary policy.

The Federal Reserve was now free to increase the money supply at will. The ever increasing demand for oil would would prevent a flight from the dollar, while distributing the inflationary consequences across the entire planet.

The dollar went from being a gold back currency to a oil backed currency. It also became America’s primary export.

Did you ever wonder how the U.S. economy has been able to stay afloat while running multibillion dollar trade deficits for decades?

Did you ever wonder how it is that the U.S. holds such a disproportionate amount of the worlds wealth when 70% of the U.S. economy is consumer based?

In the modern era, fossil fuels make the world go round. They have become integrated into every aspect of civilization: agriculture, transportation, plastics, heating, defense and medicine, and demand just keeps growing and growing.

As long as the world needs oil, and as long as oil is only sold in U.S. dollars, there will be a demand for dollars, and that demand is what gives the dollar its value.

For the United States this is a great deal. Dollars go out, either as paper or digits in a computer system, and real tangible products and services come in. However for the rest of the world, it’s a very sneaky form of exploitation.

Having global trade predominately in dollars also provides the Washington with a powerful financial weapon through sanctions. This is due to the fact that most large scale dollar transactions are forced to pass through the U.S.

This petrodollar system stood unchallenged until September of 2000 when Saddam Hussein announced his decision to switch Iraq’s oil sales off of the dollar to Euros. This was a direct attack on the dollar, and easily the most important geopolitical event of the year, but only one article in the western media even mentioned it.

In the same month that Saddam announced he was moving away from the dollar, an organization called the “The Project for a New American Century”, of which Dick Cheney just happened to be a member, released a document entitled “REBUILDING AMERICA’S DEFENSES Strategy, Forces and Resources For a New Century”.

This document called for massive increases in U.S. military spending and a much more aggressive foreign policy in order to expand U.S. dominance world wide. However the document lamented that achieving these goals would take many years “absent some catastrophic and catalyzing event – like a new Pearl Harbor”.

We are on a road that leads straight to the World War 3, but in order to see that and to fully understand what is at stake you have to look at the big picture and connect the dots. This video examines the history of the dollar, its relation to oil, and the real motives behind the wars of the past two decades.

The following are 11 international agreements that are nails in the coffin of the petrodollar.

#1 China And Russia

China and Russia have decided to start using their own currencies when trading with each other. The following is from a China Daily article about this important agreement….

#2 China And Brazil

Did you know that Brazil conducts more trade with China than with anyone else?

The largest economy in South America has just agreed to a huge currency swap deal with the largest economy in Asia. The following is from a recent BBC article….

#3 China And Australia

Did you know that Australia conducts more trade with China than with anyone else?

Australia also recently agreed to a huge currency swap deal with China. The following is from a recent Financial Express article….

#4 China And Japan

The second and third largest economies on the entire planet have decided that they should start moving toward using their own currencies when trading with each other. This agreement was incredibly important but it was almost totally ignored by the U.S. media.

According to Bloomberg, it is anticipated that this agreement will strengthen ties between these two Asian giants….

#5 India And Japan

It is not just China making these kinds of currency agreements. According to Reuters, India and Japan have also agreed to a very large currency swap deal….

#6 “Junk For Oil”: How India And China Are Buying Oil From Iran

Iran is still selling lots of oil. They just aren’t exchanging that oil for U.S. dollars as much these days.

So how is Iran selling their oil without using dollars?

A Bloomberg article recently detailed what countries such as China and India are exchanging for Iranian oil….

#7 Iran And Russia

According to Bloomberg, Iran and Russia have decided to discard the U.S. dollar and use their own currencies when trading with each other….

#8 China And Chile

China and Chile recently signed a new agreement that will dramatically expand trade between the two nations and that is also likely to lead to significant currency swaps between the two countries….

The following is from a recent report that described this new agreement between China and Chile….

#9 China And The United Arab Emirates

According to CNN, China and the United Arab Emirates recently agreed to a very large currency swap deal….

#10 China And Africa

Did you know that China is now Africa’s biggest trading partner?

For many years the U.S. dollar was dominant in Africa, but now that is changing. A report from Africa’s largest bank, Standard Bank, says the following….

#11 Brazil, Russia, India, China And South Africa

The BRICS (Brazil, Russia, India, China and South Africa) continue to become a larger factor in the global economy.

A recent agreement between those nations sets the stage for them to increasingly use their own national currencies when trading with each other rather than the U.S. dollar. The following is from a news source in India….

So what does all of this mean?

It means that the days of the U.S. dollar being the de facto reserve currency of the world are numbered.

So why is this important?

In a previous article, I quoted an outstanding article by Marin Katusa that detailed many of the important benefits that the petrodollar system has had for the U.S. economy….

So what happens when the petrodollar dies?

The following are some of the things we are likely to see….

-Oil will cost a lot more.

-Everything will cost a lot more.

-There will be a lot less foreign demand for U.S. government debt.

-Interest rates on U.S. government debt will rise.

-Interest rates on just about everything in the U.S. economy will rise.

And that is just for starters.

As I wrote about earlier today, the Federal Reserve is not going to save us. Fundamental changes to the global financial system are happening right now that are impossible to stop.

We should have never gone into so much debt. Up until now we have gotten away with it, but when demand for U.S. dollars and U.S. debt dries up we are going to experience a massive amount of pain.

Keep your eyes and ears open for more news stories like the ones referenced above. The end of the petrodollar is going to be a very significant landmark on the road toward the total collapse of the U.S. economy.

http://libertybalance2014.blogspot.com/2014/09/geopolitics-of-world-war-iii-end-of.html

Liberty Balance

Liberty Balance